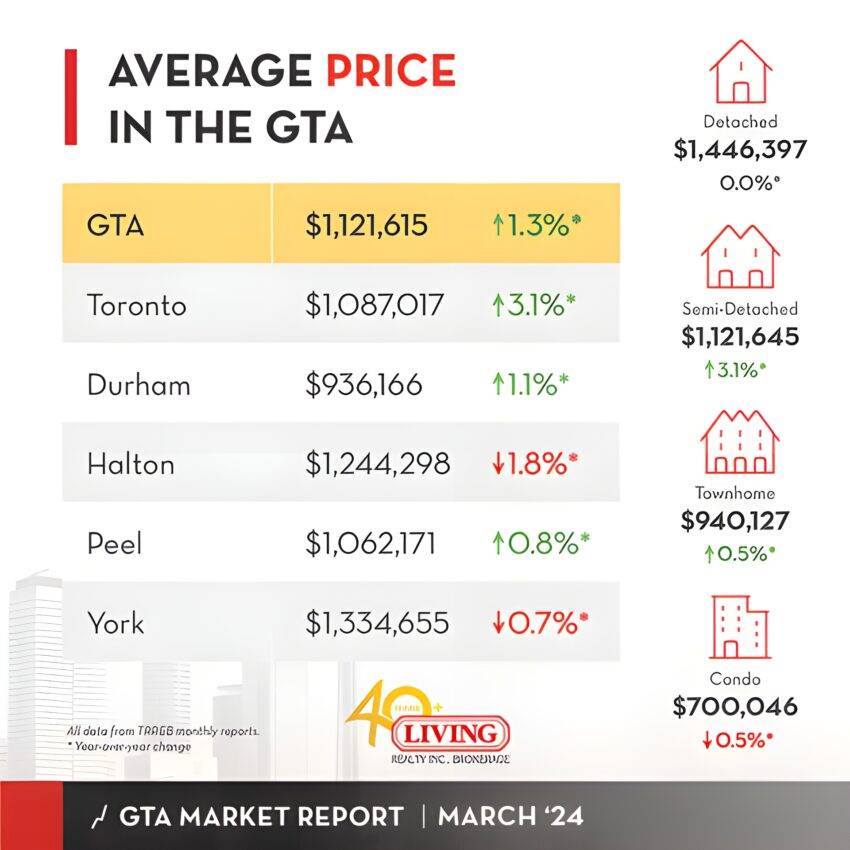

Overview: a look at how the GTA housing market performed in March 2024, a forecast of what’s to come, plus advice for buyers and sellers. Spring is a season of rebirth, and that’s what the GTA housing market experienced in March 2024. The first signs of this renewal were evident…

Tag: interest rates

An Ultimate Guide To Receivership in Canada

Overview: a guide to understanding receivership in Canada, including what it is, the process, examples, and advice on how to avoid it. The news didn’t come as a surprise, since the condo has faced years of delays and rising costs. But what is surprising is that it happened in Toronto,…

Ultimate Guide To Power of Sale Vs Foreclosures in Ontario

Overview: an in-depth guide to Power of Sale and Foreclosures in Ontario, with information on the process, risks and benefits, plus advice for homeowners. When that happens, they’re faced with two very difficult choices: Power of Sale or Foreclosure. But what do these two terms mean? And what exactly are…

Canada’s Vacant Home Tax & Foreign Buyer Ban [Updated]

Overview: a look at Toronto’s Vacant Home Tax (VHT) and Canada’s Foreign Buyer Ban, plus their impact on home sales, prices, inventory and more. Two of the biggest include Toronto’s Vacant Home Tax (VHT) and The Prohibition on the Purchase of Residential Property by Non-Canadians Act. The goal of both…

GTA Home Sales & Prices Plunge In September 2022

Overview: a look at the September 2022 housing market numbers for Toronto and the GTA, including sales, prices and inventory. Plus insights on the condo market and immigration. Home sales, prices and listings were all down big in September, but there is a silver lining. It’s still a buyer’s market,…